Anti-Money Laundering - Prevention, Detection and Contextual Awareness of High-Risk Customers

Money laundering is the practice of disguising the existence, source, control, beneficial ownership, and gain of property and/or assets derived from illegal activities. Money laundering operations are designed to take the proceeds of illegal activities, such as drug trafficking, and causing them to appear to come from legitimate sources. This session will address the process of money laundering, money laundering methods, and the systems and strategies in place to prevent and detect it.

- Know how money laundering occurs

- Understand the methods used to perpetrate money laundering

- Understand the importance of Knowing Your Customer (KYC) and the importance of an effective risk management program

- Identity targeted organizations for money laundering schemes

- Recognize key transactions or activities that trigger suspicion of money laundering

- Learn the systems in place to prevent and detect money laundering schemes

- The Money Laundering Process

- Money Laundering Methods

- U.S Federal Law

- Enforcement and Prevention Strategies

This session will provide insight into how money laundering occurs and methods for preventing and detecting it.

Professionals in the financial or related industries (Bankers, Auditors, Branch Managers)

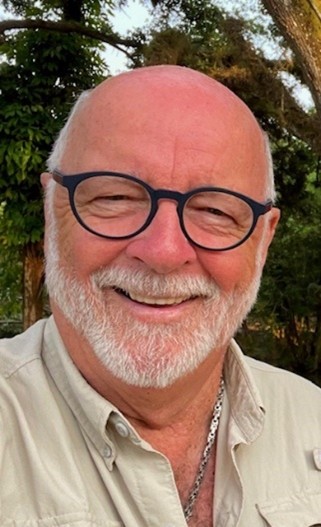

Stetson P. Marshall is the Owner and CEO of Comprehensive Consulting Group (CCG) — a risk, compliance, and operations management consulting firm based in Boston and Chicago. As a Certified Fraud Examiner with over a decade of progressive experience, Stetson draws upon his insights in internal auditing, finance & accounting, and program management to provide first-in-class advisory services that offer a holistic, panoramic review of business needs, goals, and resources. Stetson is a highly effective collaborator, known for his ability to build strong teams, foster cross-functional alignment, and lead with a vision — especially through periods of transition and change. Clients and partners find value in his refreshing approach to problem-solving and his unwavering commitment to excellence, authenticity, and integrity.

Upcoming Webinars