Form W-2 for 2023: All You Need to Know

Form W-2 is one of the most important documents that payroll departments must process. This webinar covers the IRS Form W-2 for 2023. We examine the requirements for completing and filing the form including a box-by-box explanation. The new lower thresholds for mandatory electronic filing will be reviewed. Best practices for completing and reconciling the form, and handling duplicate requests from employees are also covered. When to use the correction Form W-2c is also discussed.

For the attendee to learn and understand the 2023 requirements for the Form W-2 including:

- Changes to the Form W-2 for 2023

- NEW! Lower electronic filing thresholds for 2023

- Line-by-line completion of the Form W-2

- Reconciliation of Form W-2 to Form 941-best practices on when and why it must be done

- Electronic delivery of W-2s to employees—what is required to set up the program

- When to use the Form W-2c and when to correct the W-2 itself

- Penalties for incorrect information have doubled and how that makes it imperative to verify employee names and social security numbers with the SSA database

- Payroll Executives/Managers/Administrators/Professionals/Practitioners/Entry Level Personnel

- Human Resources Executives/Managers/Administrators

- Accounting Personnel

- Business Owners/Executive Officers/Operations and Departmental Managers

- Lawmakers

- Attorneys/Legal Professionals

- Any individual or entity that must deal with the complexities and requirements of Payroll compliance issues

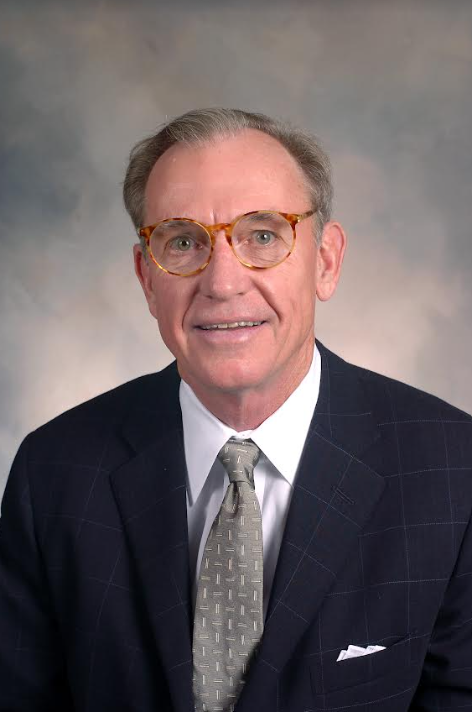

Vicki M. Lambert, CPP, is President and Academic Director of The Payroll Advisor™, a firm specializing in payroll education and training. The company’s website www.thepayrolladvisor.com offers a payroll news service that keeps payroll professionals up-to-date on the latest rules and regulations.

With 40 years of hands-on experience in all facets of payroll functions and over three decades as a trainer and author, Ms. Lambert has become the most sought-after and respected voice in the practice and management of payroll issues. She has conducted open market training seminars on payroll issues across the United States, attended by executives and professionals from some of the most prestigious firms in business today.

A pioneer in electronic and online education, Ms. Lambert produces and presents payroll-related audio seminars, webinars, and webcasts for clients, APA chapters, and business groups nationwide. Ms. Lambert is an adjunct faculty member at Brandman University in Southern California where she is the instructor for the American Payroll Association’s “PayTrain” online program offered by Brandman University.

Upcoming Webinars