What SECURE Act 2.0 Means for Tax Professionals

This session highlights the tax and non-tax provisions of the SECURE 2.0 Act of 2023. Although many of the provisions are not effective until after December 31, 2024, some are effective upon enactment of the legislation. For example, the 50 percent excise tax for failing to take an RMD is reduced to 25 percent and the RMD age increases to 73 in 2023. Thus, clients are going to hear a lot about the new legislation from the media and are going to expect you to be up on the issues.

- Review the tax provision changes that are effective after the date of enactment.

- Apply the new retroactive first-year elective deferrals rules for sole proprietors.

- Review the change of the additional 6 percent tax on corrective excess contributions.

- Present the new exceptions to the 10% early distribution tax.

- Present the other tax provision changes that are effective in the following year.

- Discuss the status of the extender provisions.

- Modifications to the small business pension plan start-up costs

- Introduction of automatic enrolment provisions and retroactive sole proprietor deferrals

- New exceptions to the 10% early distribution tax

- New catch-up limits and RMD age requirements

- Changes to individual retirement provisions, including qualified longevity annuity contracts

This webinar will present the changes to the legislation, illustrate them, and highlight the effective dates so that you can be ready to respond to your client’s inquiries.

- Tax accountants.

- Enrolled agents.

- Accountants.

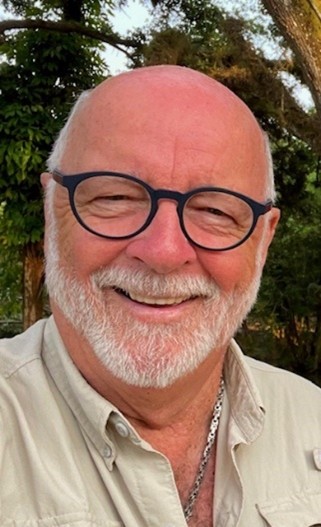

Tony Curatola’s area of research interest is the taxation of employee benefits. He has authored over 230 articles in his field and has completed sponsored research for several organizations. His findings have appeared in media such as Forbes, The Washington Post, Wall Street Journal, and The New York Times. He is the editor of the tax column for Strategic Finance, past editor of the Journal of Legal Tax Research. He holds a variety of leadership positions and currently serves as chair emeritus of the IMA Research Foundation. Tony earned his BS and MBA (finance) from Drexel University, MA from the Wharton School of the University of Pennsylvania, and PhD from Texas A&M University.

Upcoming Webinars