Bank Secrecy Act Reporting Requirements and Suspicious Activity Report

The Currency and Foreign Transactions Reporting Act of 1970—which legislative framework is commonly referred to as the Bank Secrecy Act (BSA)—requires U.S. financial institutions to assist U.S. government agencies to detect and prevent money laundering. Specifically, the act requires financial institutions to keep records of cash purchases of negotiable instruments, file reports of cash transactions exceeding $10,000 (daily aggregate amount), and report suspicious activity that might signify money laundering, tax evasion, or other criminal activities. It was passed by the Congress of the United States in 1970. The BSA is sometimes referred to as an anti-money laundering (AML) law or jointly as “BSA/AML. Several acts, including provisions in Title III of the USA PATRIOT Act of 2001, and the Anti-Money Laundering Act of 2020, have been enacted up to the present to amend the BSA. (See 12 USC 1829b, 12 USC 1951-19600, 31 USC 5311- 5314, 5316-5336, and 31 CFR Chapter X [formerly 31 CFR Part 103]).

What banks are required to do:

- Establish effective BSA compliance programs.

- Establish effective customer due diligence systems and monitoring programs.

- Screen against the Office of Foreign Assets Control (OFAC) and other government lists.

- Establish an effective suspicious activity monitoring and reporting process.

- Develop risk-based anti-money laundering programs.

- Suspicious Activity Report (SAR) is a document that financial institutions and those associated with their business must file with the Financial Crimes Enforcement Network (FinCEN) whenever there is a suspected case of money laundering or fraud. These reports are tools to help monitor any activity within finance-related industries that are deemed out of the ordinary, a precursor of illegal activity, or might threaten public safety. Suspicious activity reports are a tool provided by the Bank Secrecy Act (BSA) of 1970. Originally called a “criminal referral form” the SAR became the standard form to report suspicious activity in 1996. Mainly used to help financial institutions detect and report known or suspected violations, the USA Patriot Act expanded SAR requirements to help combat domestic and global terrorism. Whether financial or otherwise, SARs enable law enforcement agencies to uncover and prosecute significant money laundering, criminal financial schemes, and other illegal endeavors. SARs give governments an opportunity to spot and analyze emerging trends and patterns across a broad spectrum of personal and organized crimes. With this knowledge, they can anticipate and counteract fraudulent and criminal behavior before it gains a foothold.

- Other bank obligations:

- Keep records of cash purchases of negotiable instruments,

- File reports of cash transactions exceeding $10,000 (daily aggregate

- amount), and

- Report suspicious activity that might signal criminal activity (e.g., money

- laundering, tax evasion)

- What is the Bank Secrecy Act?

- What is the rationale and purpose of the BSA?

- What does the BSA require banks to do?

- What is a Suspicious Activity Report?

- When must a SAR be filed?

- What should be covered in a SAR?

- What are the consequences for banks that fail to comply?

Criminals have long used money-laundering schemes to conceal or “clean” the source of fraudulently obtained or stolen funds. Money laundering poses significant risks to the safety and soundness of the U.S. financial industry. With the advent of terrorists who employ money-laundering techniques to fund their operations, the risk expands to encompass the safety and security of the nation. Through sound operations, banks play an important role in helping investigative and regulatory agencies identify money-laundering entities and take appropriate action.

- Banking executives,

- Branch managers, and BSA officers.

- All American banks, large and small.

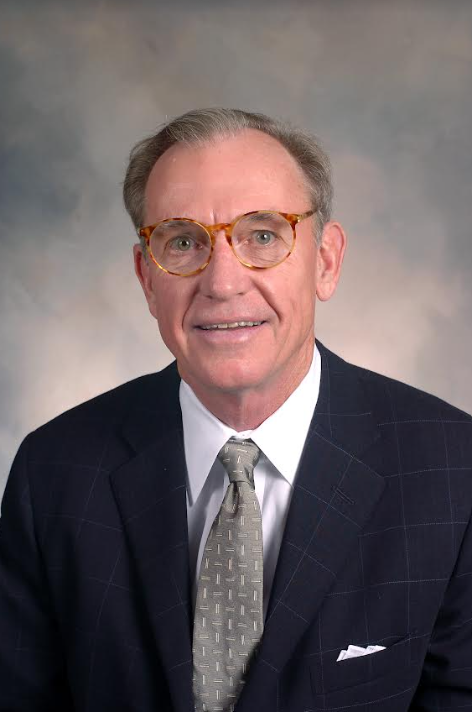

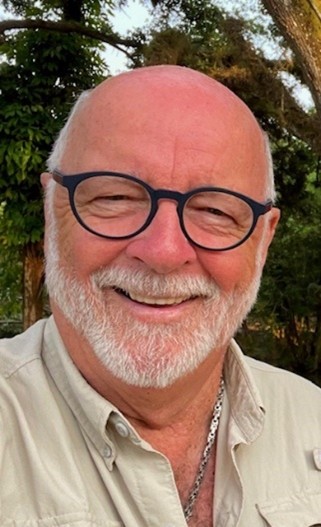

Dr. Jim Castagnera holds an M.A. in Journalism from Kent State University and a J.D. and Ph.D. (American Studies) from Case Western Reserve University. He worked 10 years as a labor, employment, and intellectual-property attorney with Saul Ewing Arnstein & Lehr and 23 years as associate provost & legal counsel for academic affairs at Rider University, where in 2018 he received the university’s highest annual award for distinguished service. He also did stints as a full-time law professor at UT-Austin and Widener University Law School.

Having retired from Rider in 2019, he is engaged in a portfolio of activities: President of Dr. Jim’s One-Stop HR Shop, a full-service HR law and compliance company; Partner with Portum Group International LLC, a data-privacy & compliance-consulting firm; Of Counsel to the Wilftek law firm; an Adjunct Professor of Law in the Kline School of Law at Drexel University, and an arbitrator for the U.S. District Court for the Eastern District of Pennsylvania.

Upcoming Webinars