Construction Lending And Real Credit Administration: Evaluating, Underwriting, And Monitoring Construction Loans

Most bankers acknowledge that construction lending is riskier than other types of commercial lending:

- Repayment ability depends on successful completion of the construction before the project can generate cash flow from the sale of the finished property, from rental or lease of the real estate, or permanent take-out refinancing

- During the construction period, the collateral is literally work-in-progress, and often the guarantors do not have sufficient outside net worth or income to pay off the loan

This webinar addresses how to mitigate the higher risk, and it offers advice and guidance on how to extend construction loans safely and profitably:

- Construction lending policy - defining a construction loan, outlining necessary information and documentation needed to evaluate construction loan, monitoring loan performance

- Appropriate underwriting and structuring - LTV, LTC, minimum equity, bonding, etc.

- Role and activities of real estate construction administration (RECAD)—sources & uses, costs review, inspections, disbursements, retention, liens, construction problem mitigation

Most bankers acknowledge that construction lending is riskier than other types of commercial lending:

- Repayment ability depends on successful completion of the construction before the project can generate cash flow from the sale of the finished property, from rental or lease of the real estate, or from permanent take-out refinancing

- During the construction period, the collateral is literally work-in-progress, and often the guarantors do not have sufficient outside net worth or income to pay off the loan

Therefore, participants will learn how to evaluate the developer’s ability to repay the construction loan, develop an appropriate underwriting of the construction project to ensure the resulting structure ensures the bank will be repaid in full, on time, and as agreed, and how to satisfactorily monitor and manage the credit exposure and the construction activity.

Course Level - Basic/Fundamental

Therefore, participants will learn how to evaluate the developer’s ability to repay the construction loan.

- Developer’s background and expertise

- Contractor’s background and expertise

- Developer’s legal structure

- Owner’s minimum equity,

- Repayment ability from project cash flow, collateral, and guarantees

Develop an appropriate underwriting of the construction project to ensure the resulting structure ensures the bank will be repaid in full, on time, and as agreed.

- Sources and uses, cost review of hard costs & soft costs, appraisal review

- LTV, LTC, DCR

- Interest reserves

- Bonding

Explain how to satisfactorily monitor and manage credit exposure and the construction activity

- Role of and activities performed by real estate construction administration (RECAD)

- Inspections and disbursements

- Reallocations and change orders

- Retention, punch lists, charge-backs

- Causes of and cures for construction problems

- Problem asset management of construction loans

- Commercial Real Estate (CRE) lenders, underwriters

- Real estate credit administration team members

- Credit policy managers

- Credit managers

- Credit Risk Managers

- Credit approval officers

- Risk Managers

- Enterprise Risk Managers

- Chief Credit Officers

- Senior Lenders

- Senior Lending Officer

- Bank Director

- Chief Executive Officer

- Bank President

- Board Chairman

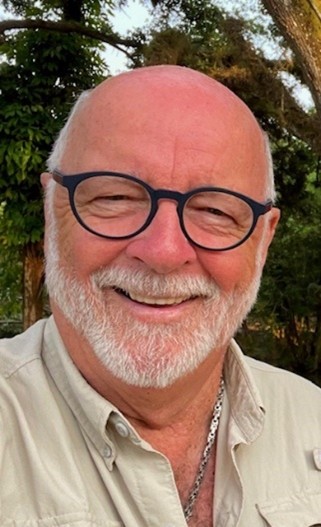

A frequent speaker, instructor, advisor and writer on credit risk and commercial banking topics and issues, Martin J. "Dev" Strischek principal of Devon Risk Advisory Group based near Atlanta, Georgia. Dev advises, trains, and develops for financial organizations risk management solutions and recommendations on a range of issues and topics, e.g., credit risk management, credit culture, credit policy, credit and lending training, etc. Dev is also a member of the Financial Accounting Standards Board’s (FASB’s) Private Company Council (PCC). PCC’s purpose is to evaluate and recommend to FASB revisions to current and proposed generally accepted accounting principles (GAAP) that are more appropriate for privately held firms. He also serves as the PCC’s representative to FASB’s Credit Losses Transition Resource Group supporting the new current expected credit loss (CECL) standard to be implemented in fiscal year 2019 for public companies and 2020 for private firms.

The former SVP and senior credit policy officer at SunTrust Bank, Atlanta, he was responsible for developing, implementing, and administering credit policies for SunTrust’s wholesale lines of business--commercial, commercial real estate, corporate investment banking, capital markets, business banking and private wealth management. He also spent three years as managing director and credit approver in SunTrust’s Florida commercial lending and corporate investment banking areas, respectively. Prior to SunTrust, he was chief credit officer for Barnett Bank’s Palm Beach market. Besides stints at other banks in Florida, Kansas City, and Ohio, his experiences outside of banking include CFO of a Honolulu construction company, combat engineer officer in the U.S. Army, and college economics instructor.

A graduate of Ohio State University and the ABA Stonier Graduate School of Banking, Dev earned his M.B.A. from the University of Hawaii. Mr. Strischek serves as an instructor in several banking schools, including the Stonier Graduate School of Banking, and the Southwest Graduate School of Banking. His school, conference, and workshop audiences have included participants drawn from the ABA, RMA, OCC, Federal Reserve, FDIC, FFIEC, SBA, the Institute of Management Accountants (IMA) and the AICPA.

Mr. Strischek has written some 200 articles on credit risk management, financial analysis and related subjects, and he is the author of Analyzing Construction Contractors and instructor of a contractor analysis workshop. A past national chair of RMA and former RMA Florida Chapter president, Dev has consulted on credit risk issues with banks in Morocco, Egypt, and Angola through the US State Department’s Financial Service Volunteer Corps (FSVC).

Upcoming Webinars